Customer Success Is A Growth Engine. You Just Need An Effective Customer Success Metric To Prove It

When preparing for QBRs or end-of-year reviews, many companies are starting to evaluate their operating budgets and plan for their next fiscal year. For many Chief Customer Officers and Customer Success (CS) leaders, this marks the beginning of a very stressful time as you prepare to have the challenging conversation with your CFO about how to properly invest in your Customer Success teams.

With global equations used to calculate investment-to-Revenue in traditional functions like Sales or Engineering , it’s often very straightforward to showcase the value and convince CFOs to invest in these organizations. For example, in Sales, you can take your Annual Revenue Target, divide it by the Projected Revenue Attainment Per Headcount (factoring in some ramp time) and out comes a Headcount projection. While this is an oversimplified example, it highlights the point that it’s a lot easier for CFOs to understand and accept the investment strategy in these areas of the business. In contrast, newer functions like Customer Success don’t have a standard set of metrics that can be used to easily showcase the ROI. This makes it challenging to secure investment.

Considering this, how can you initiate a similar conversation with your CFOs and make the discussion around Customer Success budgeting as pointed?

In this article, we introduce a new Customer Success metric to help you effectively measure the impact of your CS organization, definitively prove the ROI of Customer Success and garner eager investment from your CFO.

NDR Efficiency: The New Customer Success Economics

As you embark on the budgeting process with your CFO, there are a few questions that are sure to come up:

- What are your Customer Retention Costs (CRC)?

- What are your CSM ratios?

- What are you doing to drive efficiencies in your CS motion and drive down costs?

- How are you scaling your team?

- How are you measuring your team’s performance?

CFOs are always going to ask their CCOs to think about costs and retention. Instead, what if we changed the conversation to focus on growth and talked about Net Dollar Retention (NDR) and the investments required to drive recurring revenue growth?

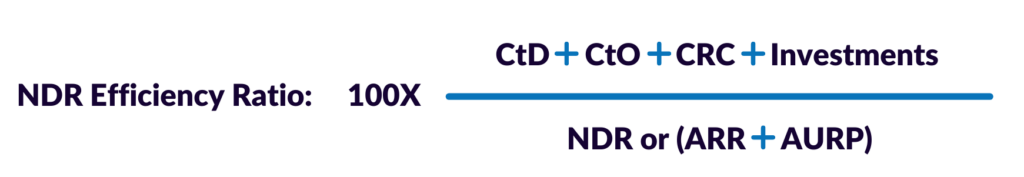

To help solve the problem of how to properly budget and invest in Customer Success programs, and enable CCOs and the CFOs to have metrics-based conversations, we’ve created a new metric called NDR Efficiency. NDR Efficiency calculates the costs to deliver revenue growth by customer. This formula allows you to determine if you are over, under or correctly investing in your Customer Success teams to deliver market-leading NDR growth for your business. Simply put, the calculation is Cost divided by Expected Revenue Growth. Below, we breakdown and detail the various elements of this new growth measurement:

Costs

When evaluating Customer Success costs, the focus is often on Customer Retention Costs, which is simply a calculation of the cost of your CS organization. To provide a more holistic view of costs to your CFO, we recommend factoring in these additional costs in your calculations:

- Cost to Deploy (CtD): The costs associated with deploying a new customer or a new use case. These costs can be monetized or considered investments.

- Costs to Operate (CtO): The costs associated with the ongoing operations of a customer. For example, the systems, tools, Operations team and other supporting functions required to keep the customer running, ensure proper system capacity and scale for future use cases.

- Customer Retention Costs (CRC): these are the costs commonly associated with driving adoption and outcomes for your customers. This typically includes your Customer Success costs and, in some scenarios, your Support organization costs.

Other Investments: In some of your more strategic customers, you might decide to provide other investments or pro-bono services to drive growth. These should also be considered and incorporated in your costs.

Projected Revenue Growth

Projected revenue growth is where NDR Efficiency flips the script. Instead of zooming in on retention and retention costs, the focus is now on revenue growth. To take this important shift into account, your calculation should consider one of the following:

- Net Dollar Retention (NDR): NDR is the projected revenue growth, year over year, you expect from your customers. This includes downsells, churn and expansions.

- ARR+AURP: What is ARR+AURP, you ask? This is the forecasted growth per customer, based on account planning. It combines the current revenue (ARR) plus the revenue potential (AURP) of your customers.

- ARR is Annualized Recurring Revenue or the amount of revenue your customers pay you, normalized to a full year.

- AURP is the Annualized Untapped Revenue Potential. It’s the revenue (annualized) a company is capable of generating if it were to take full advantage of the opportunities available including upsell, cross-sell and expansions. AURP could be based on future opportunities already identified or a propensity to expand revenue based on fit and market for your solution.

Note: Either NDR or ARR+AURP should be used as your denominator in this equation, not both. If your organization is able to forecast untapped revenue potential and propensity to expand within your accounts, we recommend using ARR+AURP as your denominator. If not, then leverage your projected NDR growth metric as your denominator.

Once you’ve defined your costs and your projected revenue growth, how do you calculate NDR Efficiency and what does exceptional performance look like?

The NDR Efficiency Formula & Scale

0-4: Under Invested for revenue growth

- If you are in this area, you might not be investing enough in your Customer Success organization to drive the right revenue growth.

5-16: Great to Good level of investment for revenue growth

- This is the sweet spot, and shows that you are investing in the right areas based on your revenue growth potential.

17-22: Poor level of investment for revenue growth

- You should start to consider driving more efficiencies in your programs, or look to build out a scale engine to drive more automation.

23+: Over invested for revenue growth

- At this stage, you should examine your CS Operations and overall Cost-to-Serve as your organization might be out of alignment.

If results indicate that you might be over invested, or rated as poor, that does not mean that your Customer Success motion is inefficient. This could signal that you have a high Cost-to-Serve in other areas of your organization. Remember, this formula looks at deployment and operation costs as well so, In this case, you may want to investigate your onboarding experience and your product experience. Either of these could be driving higher Cost-to-Serve and could indicate an area of focus to drive down the investment to NDR.

Showcase The Value Of Customer Success Using Your Senior Leadership’s Language: Metrics & Numbers

Having the same conversations year-in and year-out about budgeting and investing in Customer Success just won’t cut it anymore; you need to drastically update and improve how you measure your Customer Success Operations to keep up with a rapidly evolving industry and use that to secure enthusiastic investment and buy-in from your C-Suite Leaders and Board.

Net Dollar Retention is a key value metric in SaaS organizations and forms the basis of this new Customer Success economics. Read our recent article to learn the what, why and how of your most important success metric.